Connbiz

A cutting-edge fintech solution for digital payments and communications, serving businesses and individuals alike.

Services Used

Product & Service Design, Application Development, Quality Assurance & Testing

Industry

Fintech

[ ABOUT THE CLIENT ]

Customer

Our customer for this project is a company that aims to revolutionize the payment and communication landscape by providing an efficient, effective, and secure platform for businesses and individuals.

The client approached QatSol with the challenge of developing a comprehensive solution that integrates secure payment functionalities with robust communication tools.

The platform needed to ensure high levels of security, regulatory compliance, and seamless interoperability with existing systems. Additionally, the solution had to offer an exceptional user experience, support scalability, and be reliable across multiple platforms.

[ redefining payments ]

Challenge

The client approached QatSol with the challenge of developing a comprehensive solution that integrates secure payment functionalities with robust communication tools. The platform needed to ensure high levels of security, regulatory compliance, and seamless interoperability with existing systems. Additionally, the solution had to offer an exceptional user experience, support scalability, and be reliable across multiple platforms.

[ Team ]

It took 21 QatSolers to develop the payments app from scratch

1

Project Manager

Orchestrated seamless communication, managed project milestones, and ensured alignment with client expectations

2

Product Managers

Oversaw product strategy, roadmap development, and feature prioritization to meet market demands and client goals

2

System Analysts

Conducted detailed analysis of system requirements, ensuring precise alignment with technical specifications and user needs

1

Business Analyst

Gathered and synthesized client requirements, translating them into actionable insights for the development team

3

Frontend Developers

Implemented responsive and interactive interfaces across platforms using React.js and React Native, optimizing usability and functionality

5

Backend Developers

Engineered a scalable, secure, and high-performance backend infrastructure using Microsoft .NET and PostgreSQL, ensuring robust data management and processing capabilities

2

QA Engineers

Conducted rigorous testing throughout the development lifecycle, employing automated and manual testing techniques to ensure system reliability and performance

3

AI/ML Experts

Integrated advanced AI-driven features, including personalized content filtering and intelligent recommendation systems, leveraging NLP and MLOps techniques

2

UX/UI Designers

Crafted intuitive and visually appealing interfaces for both web and mobile platforms, enhancing user experience and engagement

[WE HIRE THE BEST TALENT]

Industry-leading tech stack

With over 500 developers, expert engineers, and cutting-edge tools, QatSol is fully equipped to help you design scalable architectures, implement robust development pipelines, create custom automation solutions, and achieve your technology goals.

[ connbiz ]

Solution

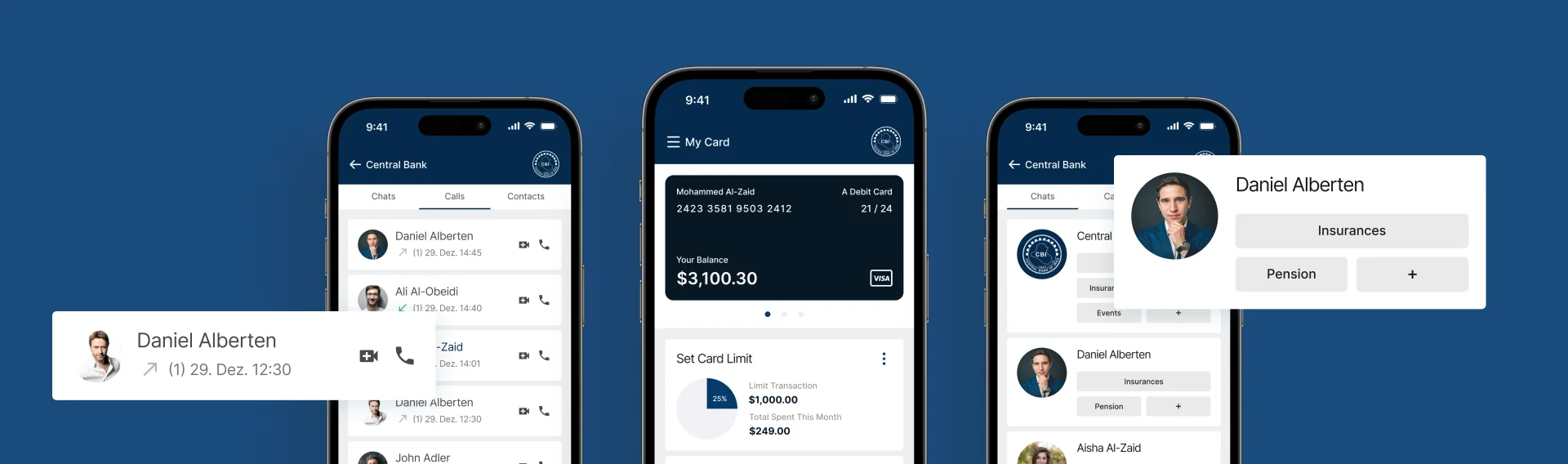

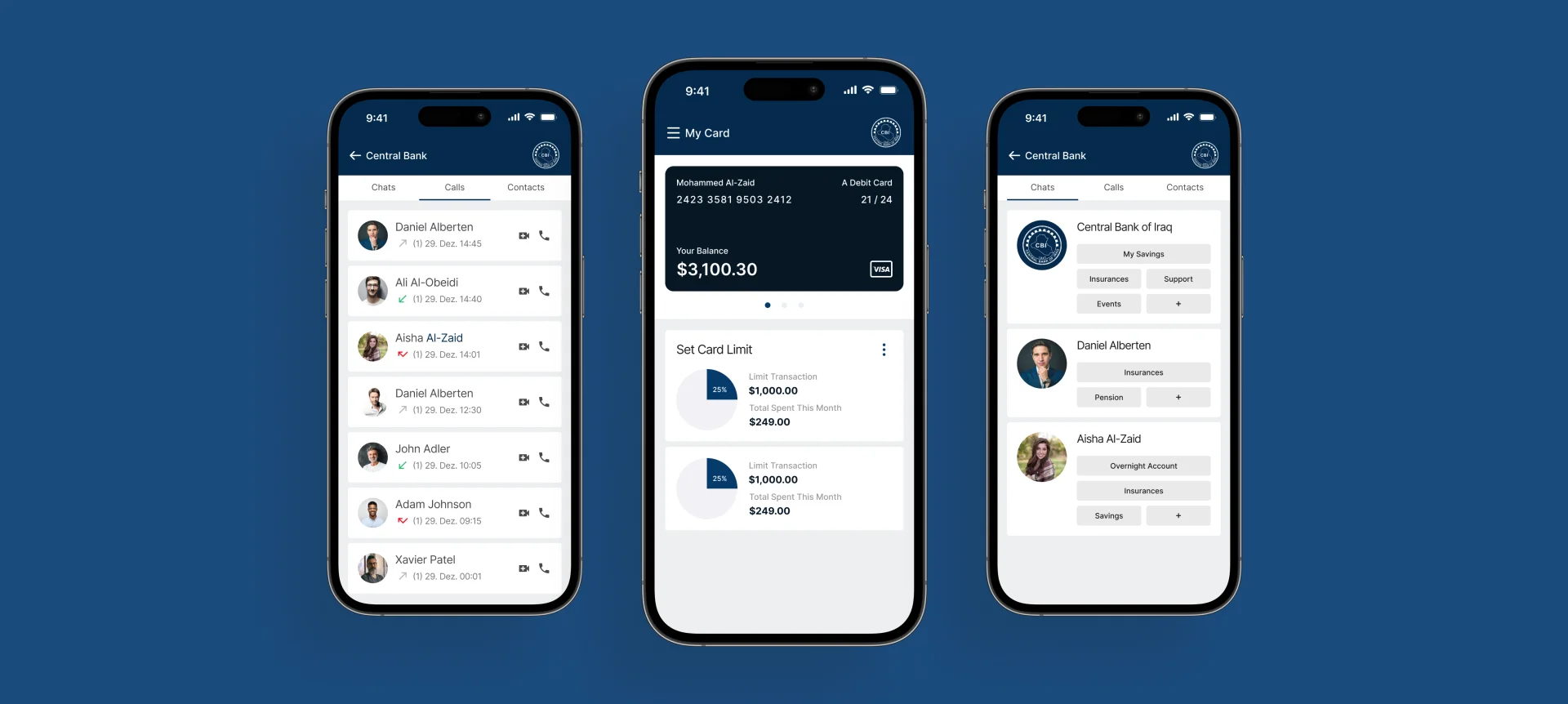

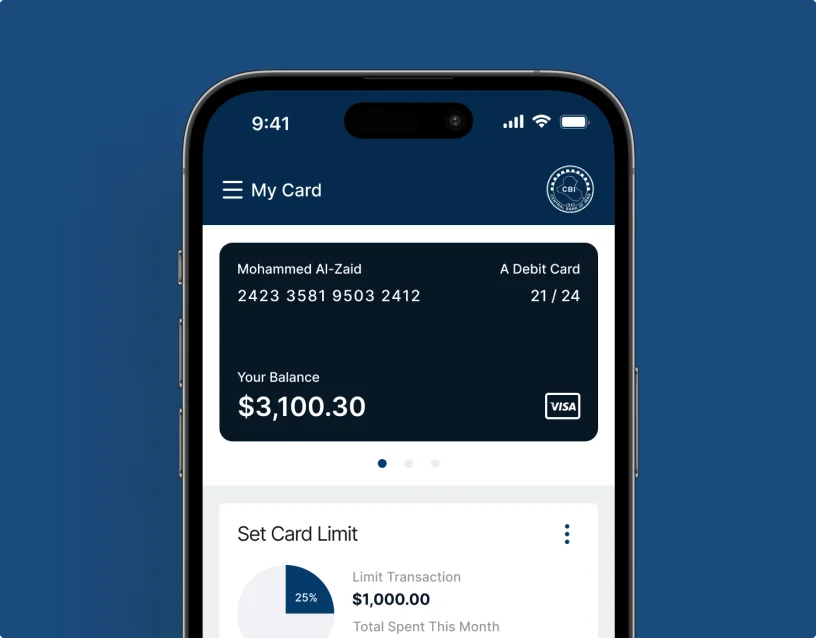

QatSol developed ConnBiz, an all-in-one payment and communication solution designed to meet the diverse needs of businesses and consumers. This platform combines secure digital payments, real-time communication, and advanced security features in a user-friendly interface. ConnBiz supports a wide range of devices and ensures end-to-end encryption, making it a reliable and expandable solution for modern financial and communication needs.

ConnBiz has successfully integrated seamless payment and communication functionalities into a single platform, offering unparalleled security and user experience. The platform supports thousands of users globally, ensuring secure transactions and efficient communication for businesses and individuals.

[ HOW WE DEVELOP ]

Process

01

Discovery and Planning

Our team started by closely collaborating with the client to understand their specific needs and challenges. We gathered detailed insights, set clear project goals, and developed a solid plan that aligned perfectly with their vision and objectives.

02

Technology Selection

For ConnBiz, we chose cutting-edge technologies like Angular.js and Rails for frontend development, Microsoft .NET and PostgreSQL for backend operations, and React Native for seamless cross-platform compatibility. Microsoft Azure was selected for its scalability and secure cloud infrastructure, crucial for supporting a global user base and ensuring data security.

03

Design and Development

Our UI/UX designers crafted intuitive interfaces based on user feedback, focusing on delivering a seamless experience. Simultaneously, our development team used agile practices to integrate frontend and backend components, adapting quickly to optimize performance.

04

QA and Testing

Quality assurance was a top priority throughout. Our QA engineers rigorously tested using comprehensive suites and automation tools to ensure robust functionality, security, and performance, meeting high standards of reliability and user satisfaction.

05

Deployment and Support

Following thorough testing and client approval, ConnBiz launched on Microsoft Azure. We provide ongoing maintenance and support, ensuring seamless service, timely updates, and responsiveness to user needs.

[ a comprehensive payment solution ]

Features

Core Modules

- Authentication: Includes digital signatures, password protection, PIN, and biometric identification for secure user verification.

- Encryption: Protects information with HTTPS/TLS, secure server updates, and verified communication channels.

- Fraud Detection: Detects unauthorized access and suspicious activities, notifies users, freezes accounts, and informs the company.

- Tracking: Provides an overview of money transfers, AI analysis of suspicious transactions, and detailed tracking of transactions.

Communication Features

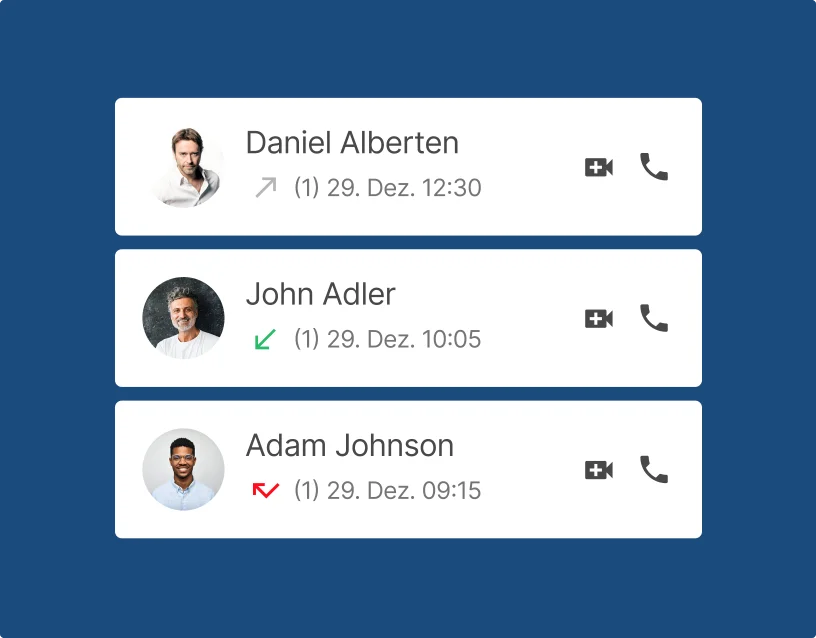

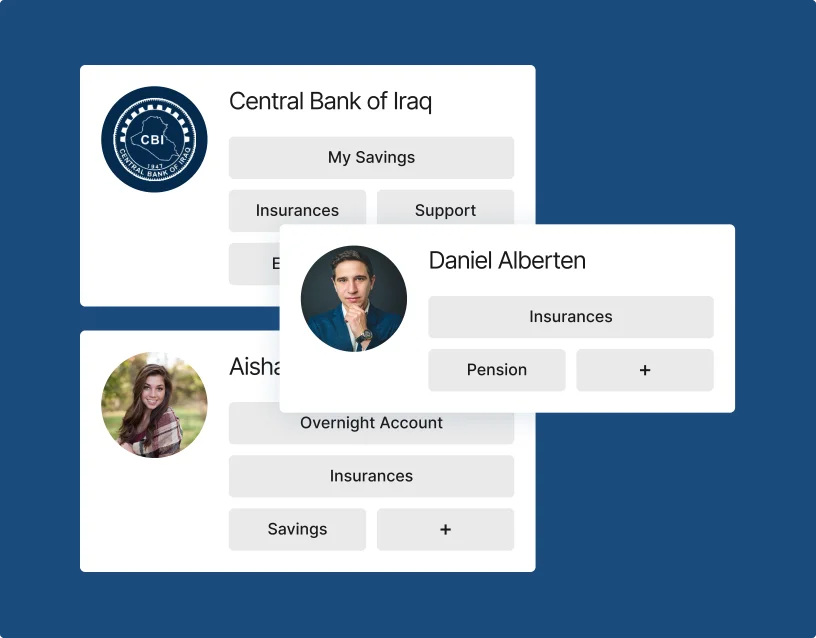

- Single & Group Chats: Enables efficient team communication with up to 8 subject areas per chat, structured and organized for comprehensibility.

- Digital Payment: Facilitates payments in all stores and businesses, with card limit management and transaction archiving.

- E-Wallet: Offers information about bank accounts, contact with financial counselors, and service extensions.

Additional Features

- AI: Automated analysis and fraud detection.

- Optional Features: Includes polls, calendar, voice & video calling, and conferences.

- Bills/Payments: Provides transaction statistics, payment overviews, and detailed information.

Security Features

- Secure Payment & Banking: Ensures safe transfers with TLS 1.3 encryption.

- E2E Encryption: Uses signal protocol for end-to-end message and content encryption.

- Message Signature: Ensures message integrity with HMAC.

- Remote Maintenance: Performs maintenance and support securely.

Cross-Device Communication

- Supports smartphones, tablets, notebooks, and desktops with local payment systems and ensures consistent infrastructure availability on client servers.

Future Functions

- Financial Planning Tool: Includes budget tracking, spending analysis, and chatbots for better financial management.

- Voice Bots: Provides personalized financial recommendations and alerts.

- Social Functions: Enables sharing money with family and friends, and includes creative and gamification features like badges and rewards.

[ value-driven ]

Results

Since its launch, ConnBiz has redefined the payment landscape for the client.

Enhanced Security

ConnBiz, developed by QatSol, features TLS 1.3 and end-to-end encryption, ensuring secure transactions and communications. This robust security framework has enabled ConnBiz to gain regulatory approval across multiple regions, ensuring safe and legal operations

Improved UX

ConnBiz offers a user-friendly interface across various devices, supporting thousands of users globally with high performance and reliability. This scalability has facilitated rapid expansion, catering to both individuals and large enterprises.

Fraud detection

ConnBiz integrates real-time communication tools with secure digital payments, allowing seamless management of payments and business communications. AI-driven fraud detection and advanced tracking enhance the platform’s security and efficiency, providing a comprehensive user experience.

[ TECH STACK ]

Technologies & tools

Ready to execute your product vision?